NAIC survey: 88% of insurers are utilizing AI or mechanical device studying – Insurance coverage Information

A up to date survey of car insurers discovered that 88% of insurers these days use, plan to make use of or plan to discover utilizing synthetic intelligence or mechanical device studying as a part of their on a regular basis operations.

The Nationwide Affiliation of Insurance coverage Commissioners revealed the document by way of the Giant Information and Synthetic Intelligence Operating Team. It is a part of a wide-ranging effort at the a part of a number of NAIC teams to get a greater seize on synthetic intelligence and large information utilization in insurance coverage.

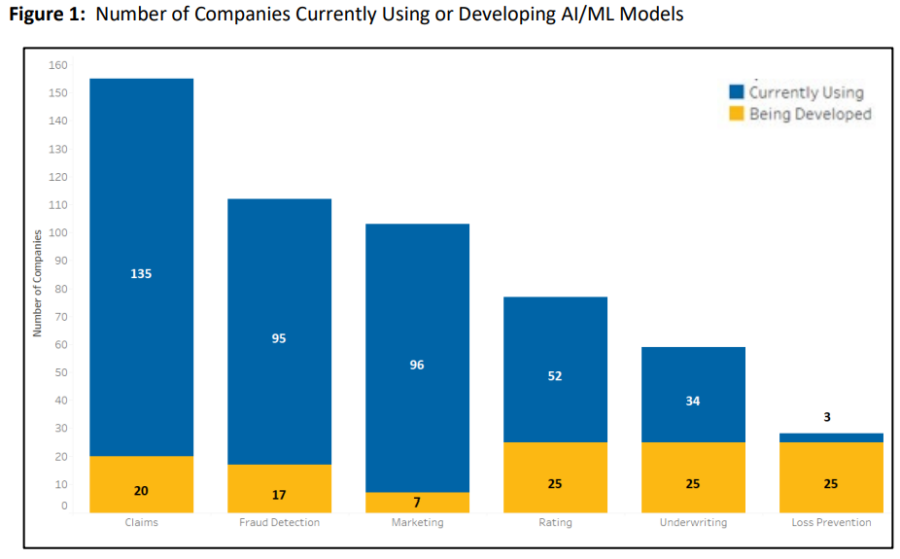

The 193 respondents to the Non-public Passenger Auto Synthetic Intelligence/Device Studying Survey say they’re staying clear of the debatable makes use of of AI and knowledge monitoring. Maximum respondents stated they’re utilizing AI/ML in claims, adopted by way of advertising and fraud detection, and just a minority utilizing it for underwriting, score and loss prevention.

The PPA survey was once performed below marketplace habits exam authority of 9 states: Connecticut, Illinois, Iowa, Louisiana, Nevada, North Dakota, Pennsylvania, Rhode Island, and Wisconsin. The survey was once restricted to just higher firms, outlined as the ones PPA writers with greater than $75 million in 2020 direct top rate written.

Selecting a definition

NAIC regulators have positioned a better emphasis on AI, large information and connected era in recent times. A number of states have followed rules as smartly. The fear is that era will create computerized processes that discriminate, even inadvertently, towards customers in keeping with race, faith, intercourse or different elements.

Legislators in numerous states, Colorado and California, for instance, have acted to rein in use of AI and large information thru new rules. Insurers favor uniform rules so they do not have to agree to other necessities in several states. However it will already be too overdue for the NAIC to create a uniform fashion of requirements.

In keeping with analysis company IDC, using AI answers within the insurance coverage marketplace will develop 32 % by way of 2026. World spending on AI will greater than double by way of then to over $300 billion, the company predicted.

In keeping with the survey, claims is the preferred utility of AI and ML. Out of 193 reporting firms, 135 reported utilizing AI/ML for claims operations, and 20 reported having

fashions below development.

“Firms reported these days utilizing AI/ML claims fashions most commonly as an informational useful resource for adjusters (96 firms),” the survey reads. “Few firms are utilizing AI/ML claims fashions for claims approvals (9) and none are utilizing them for claims denials. Different AI/ML claims fashions are these days used to resolve declare agreement quantities (50), to make declare task choices (58), to judge photographs of loss (55), and for different claim-related purposes (66).”

Here’s a complete breakdown of AL/ML makes use of as reported by way of respondents:

5 targets

Regulators laid out 5 key targets for the survey. They’re:

1. To be told immediately from the trade about what is occurring on this house.

2. To get a way of the present stage of chance and publicity and whether or not or how the trade is managing or mitigating that chance.

3. To broaden data for trending, comparable to how the danger is evolving through the years, and the trade’s responsive movements.

4. To tell a significant and helpful regulatory manner, framework, and/or technique for overseeing and observe on this job,

5. To be told from prior surveys to tell and reinforce long term surveys.

The Giant Information and Synthetic Intelligence Operating Team meets March 22 on the NAIC Spring Assembly in Louisville. Dialogue of AL/ML surveys is at the schedule.

InsuranceNewsNet Senior Editor John Hilton coated industry and different beats in additional than twenty years of day-to-day journalism. John is also reached at [email protected]. Observe him on Twitter @INNJohnH.

© Complete contents copyright 2023 by way of InsuranceNewsNet.com Inc. All rights reserved. No a part of this text is also reprinted with out the expressed written consent from InsuranceNewsNet.com.

Supply Via https://insurancenewsnet.com/innarticle/naic-survey-88-of-insurers-are-using-ai-or-machine-learning