Pandemic buyers nonetheless have the fever – Insurance coverage Information

Even if it’s been a few loopy years within the markets, maximum buyers in a bunch that began within the pandemic’s early days in 2020 are nonetheless within the recreation, in step with a follow-up find out about.

The FINRA Investor Schooling Basis and NORC on the College of Chicago carried out the primary find out about in 2020 to grasp buyers who opened their first taxable funding accounts and examine them to skilled buyers who opened further accounts on the identical time.

When the researchers returned to the members, they discovered that almost all of each teams (78.9%) had been nonetheless making an investment, even supposing it was once a bigger majority of the skilled buyers (88.6%) than the brand new ones (75.2%).

No longer handiest did they nonetheless have energetic accounts, the buyers had been energetic of their accounts.

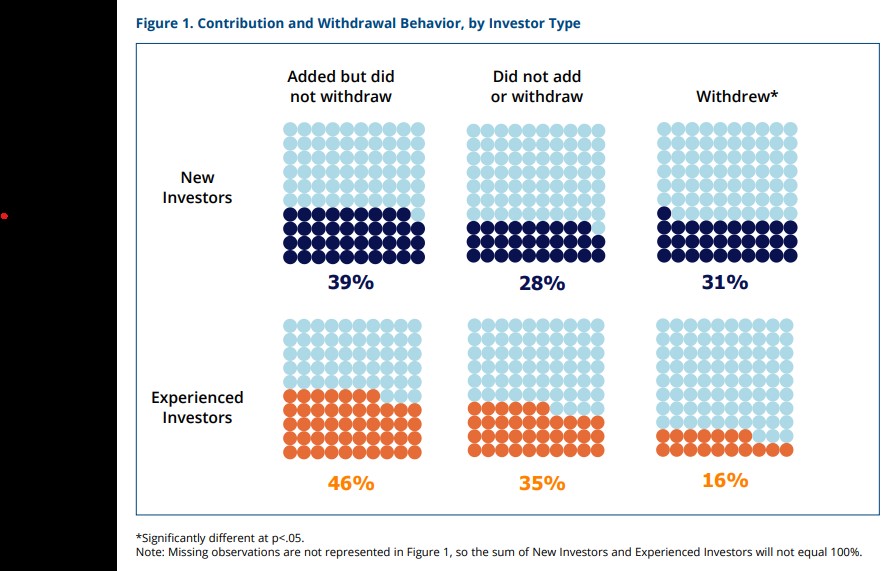

“Along with last out there, we see proof of buyers leaning in to making an investment by means of including budget to their accounts,” in step with the file. “When requested about account job, nearly part of Skilled Buyers (46.1 p.c) added budget to their accounts with out retreating budget at any time all the way through the duration into consideration.”

New buyers had been much more likely to withdraw cash from the accounts, with just about a 3rd (31%) doing so in comparison to 16.3% of skilled buyers pulling cash out.

Even if it’s been a unstable journey for markets during the last 3 years, the find out about’s buyers appeared to stay stable on their possibility tolerance, which was once low to start with. Simply 5.1% traded on margin and 11.6% traded choices. Their wisdom additionally didn’t alternate a lot, with only a 6.3% development in an making an investment quiz. New buyers progressed probably the most, by means of 9%, whilst the skilled ones higher 3%. The diversities didn’t range considerably alongside demographic traces.

The variation gave the impression of their intentions. Those that opened an account to be informed about making an investment tended to extend their making an investment wisdom considerably, by means of 21.5% on moderate.

Having a look to advisors

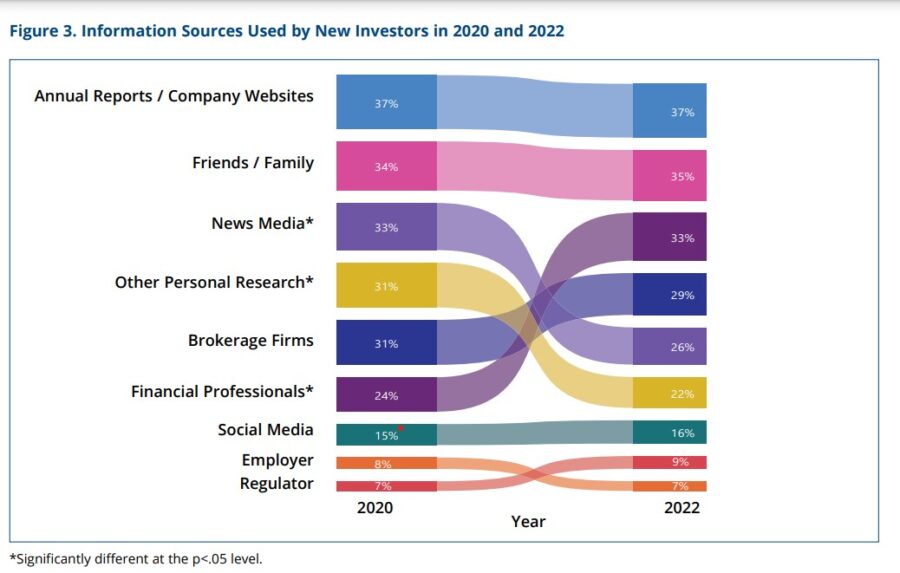

Even if many began on their project to be informed extra about making an investment, extra of the brand new buyers became to monetary advisors and clear of their very own analysis.

“This shift in using monetary pros is considerable: In 2020, knowledge from monetary pros was once the 6th maximum continuously cited supply, whilst in 2022 it was once the 3rd maximum continuously cited knowledge supply,” in step with the file.

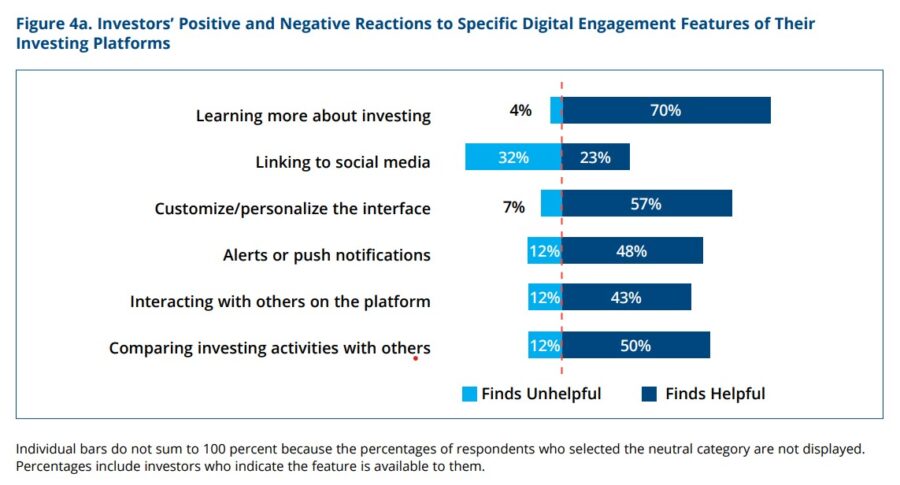

They’re additionally fascinated with their making an investment. In a brand new collection of questions, the researchers requested about virtual platforms. They sought after the options that allowed them to be informed with 70% discovering that useful. A smaller majority (57%) additionally preferred having the ability to customise and personalize the consumer interface. The similar proportion additionally preferred getting loose inventory or cryptocurrency upon opening an account.

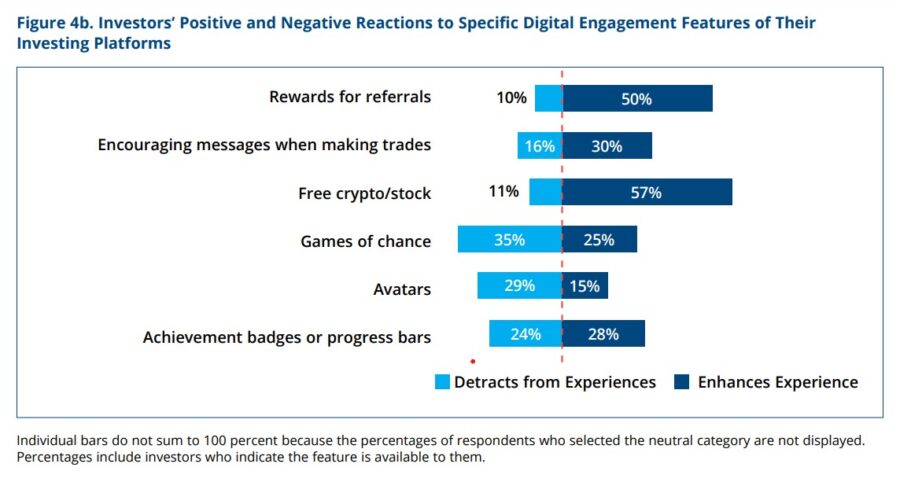

They weren’t completely enthused about video games of likelihood when the use of an account, with 35% announcing it detracted from the revel in. Additionally, being ready to make a choice an avatar was once detracting for 29%. A 3rd (32%) discovered it unhelpful so that you could hyperlink the consumer interface with social media.

Entering cryptocurrency

Even if their possibility tolerance didn’t appear to switch a lot, new and skilled buyers did a deeper dive into cryptocurrency.

In 2020, 14.1% of recent buyers and 19.1% of skilled Buyers held choice investments, which integrated crypto, gold or hedge budget. In 2022, the researchers requested about crypto in particular and located 28.1% of recent buyers and 22% of the skilled buyers held virtual foreign money.

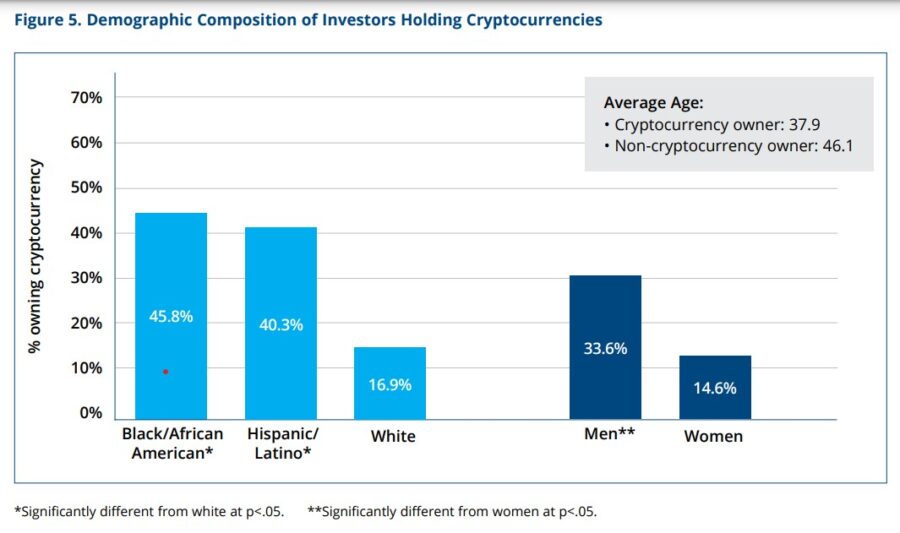

This was once a space that did fluctuate alongside demographics. They tended to be more youthful, Black, Hispanic and male by means of a big margin, and extra possibility tolerant.

Crypto holders additionally tended to have a decrease steadiness of their account general, with 59.6% having funding balances beneath $2,000, whilst handiest 27.3 p.c of buyers who don’t personal cryptocurrency held not up to $2,000 of their accounts.

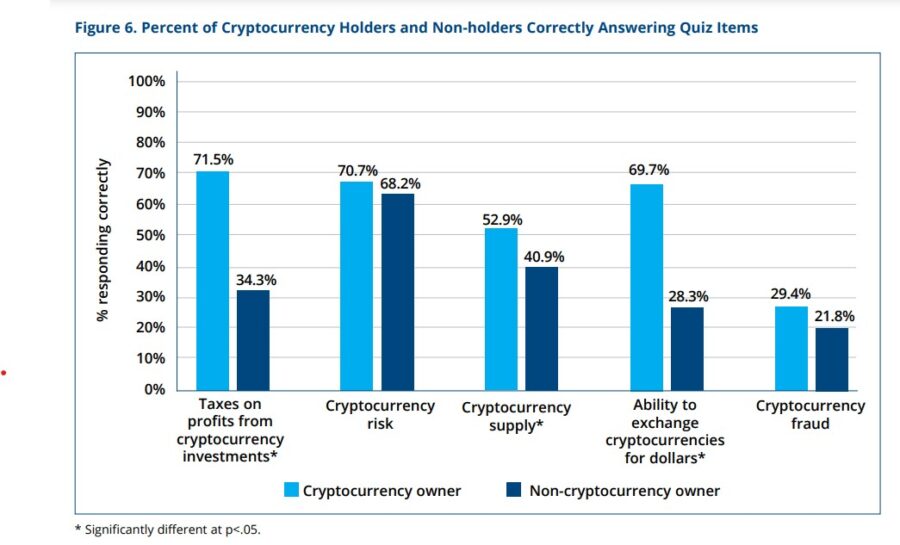

Whether or not they had been within the crypto recreation or now not, the buyers knew extra about virtual foreign money than they did about making an investment on the whole, in step with the file. Those that had been into crypto did appear to understand their stuff on virtual foreign money, regardless that.

Although the buyers knew much less about making an investment, they idea they knew extra.

“Even if buyers would possibly objectively know extra about cryptocurrency than making an investment on the whole (as measured by means of our quizzes), they subjectively imagine they know extra about basic making an investment,” in step with the file. “Best 10.1 p.c of research members indicated they’ve prime or very prime wisdom of cryptocurrency, whilst 19.7 p.c indicated they’ve prime or very prime wisdom of making an investment on the whole.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has greater than 25 years of revel in as a reporter and editor for newspapers and magazines. He was once additionally vice chairman of communications for an insurance coverage brokers’ affiliation. Steve may also be reached at [email protected]

© Whole contents copyright 2023 by means of InsuranceNewsNet. All rights reserved. No a part of this text could also be reprinted with out the expressed written consent from InsuranceNewsNet.

Supply By means of https://insurancenewsnet.com/innarticle/pandemic-investors-still-have-the-fever